- Picture and text skills

- Case

Returns the interest rate for each period of the annuity. The function RATE is calculated iteratively and may have no or multiple solutions. If the two consecutive results of RATE do not converge to 0.0000001 after 20 iterations, RATE returns the #NUM! error value.

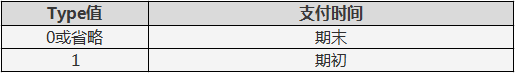

SyntaxRATE(nper,pmt,pv,fv,type,guess) For a detailed description of the parameters in the function RATE, please See function PV. nper is the total investment period, which is the total number of payment periods for the investment. pmt is the payment amount in each period, and its value remains unchanged throughout the investment period. Typically pmt includes principal and interest but not other fees or taxes. If pmt is omitted, the fv parameter must be included. pv is the present value, which is the amount of money that has been recorded from the beginning of the investment, or the cumulative sum of the current value of a series of future payments, also called principal. fv is the future value, or the desired cash balance after the last payment. If fv is omitted, its value is assumed to be zero, that is, the future value of a loan is zero. type A number 0 or 1 that specifies whether payment is due at the beginning or end of each period. guess is the expected interest rate.

• If the expected interest rate is omitted, it is assumed to be 10%. • If the function RATE does not converge, change the value of guess. Normally the function RATE converges when guess lies between 0 and 1.

ExplanationConfirm the consistency of the specified guess and nper units for a 6-year loan with an annual interest rate of 12% , if paid monthly, guess is 12%/12, nper is 6*12; if paid annually, guess is 12%, nper is 6.

支付宝扫一扫

支付宝扫一扫

评论列表(196条)

测试