According to the newly introduced policies in 2022 to support the development of small and low-profit enterprises, encourage enterprises to increase investment in research and development, and promote enterprise innovation and development, etc. There are also many changes in the corporate income tax preferential policies and the filling rules and content of the "Details of Preferential Tax Exemptions, Deductions for Income and Super Deductions" (A107010). The editor will take you to the theme of this issue - "Detailed Schedule of Tax Exemptions, Income Subtractions and Super Deductions".

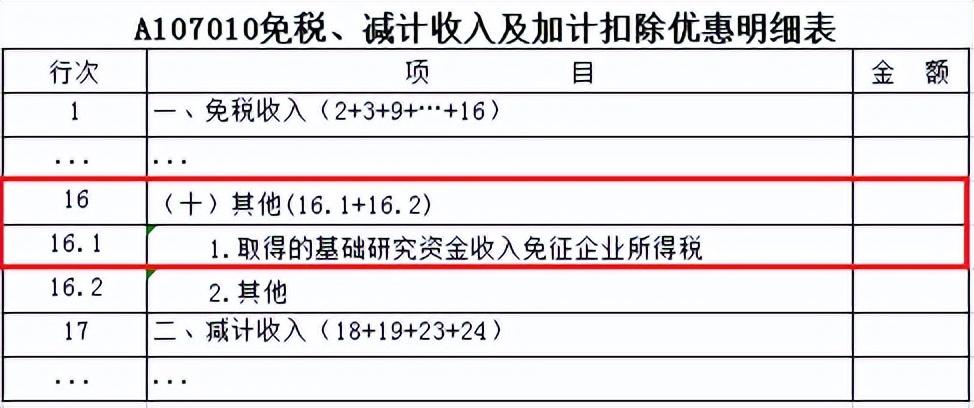

Change 1

New line 16.1. Non-profit scientific research institutions, universities and government natural science fund management units that comply with the "Announcement of the Ministry of Finance and the State Administration of Taxation on Preferential Tax Policies for Enterprise Investment in Basic Research" (2022 No. 32) Fill in the form.

●【Policies】

Non-profit scientific research institutions and colleges and universities receiving basic research funds from enterprises, individuals and other organizations are exempt from corporate income tax. .

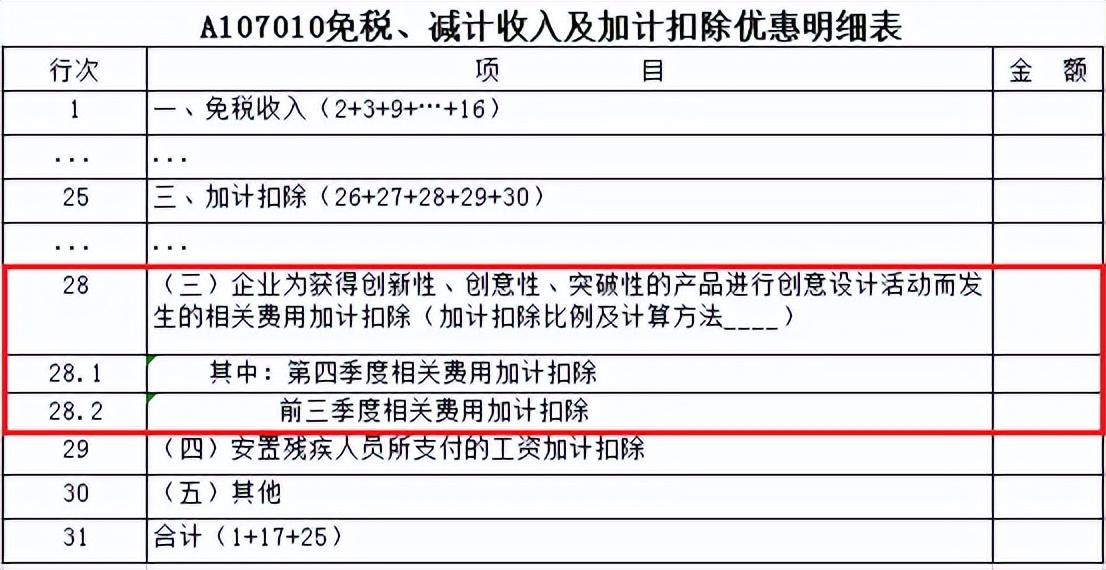

Change 2

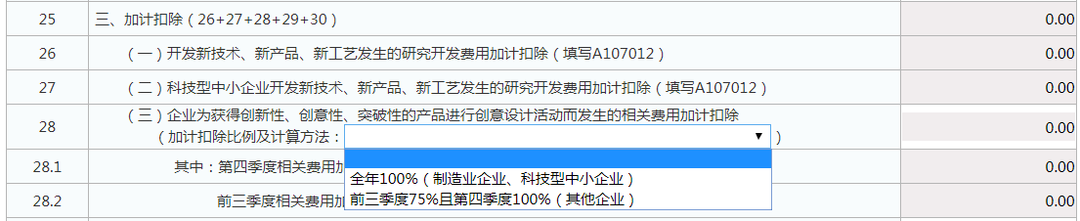

Adjust the project name in line 28; add lines 28.1 and 28.2. Enterprises that incur additional deductions for related expenses for creative design activities to obtain innovative, creative, and breakthrough products shall, according to the "Ministry of Finance, State Administration of Taxation, and the Ministry of Science and Technology's Notice on Increasing Support for Scientific and Technological Innovation before Tax Announcement on Deduction Efforts" (2022 No. 28).

●【Policies】

Enterprises that currently apply for a pre-tax super deduction ratio of 75% for R&D expenses will be eligible for the tax deduction period from October 1, 2022 to December 2022. During the period of March 31, the pre-tax super deduction ratio increased to 100%.

When an enterprise enjoys the preferential super deduction of R&D expenses in the 2022 corporate income tax final settlement calculation, the R&D expenses in the fourth quarter can be borne by the enterprise. You can choose to calculate it based on the actual number incurred, or calculate it based on the actual R&D expenses incurred throughout the year multiplied by the number of operating months after October 1, 2022, accounting for the proportion of its actual operating months in 2022.

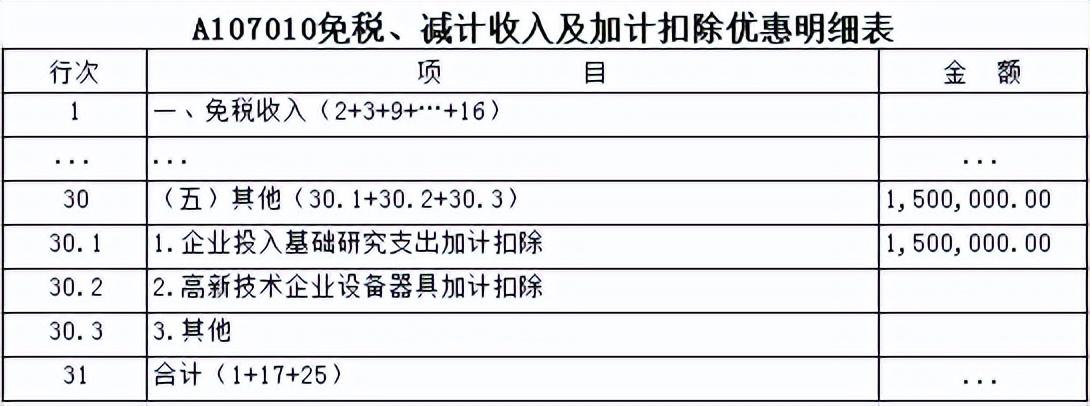

Change 3

Added lines 30.1 and 30.2. Investment enterprises that comply with the "Announcement of the Ministry of Finance and the State Administration of Taxation on Preferential Tax Policies for Enterprise Investment in Basic Research" (2022 No. 32) fill in line 30.1; "Announcement on Supporting Pre-tax Deductions for Scientific and Technological Innovation" (2022 No. 28) high-tech enterprises fill in line 30.2.

●【Policies】

① Enterprises contribute funds to non-profit scientific and technological research and development institutions, universities and government natural science funds for basic research Expenditures can be deducted before tax based on the actual amount when calculating taxable income, and can be deducted additionally before tax at a rate of 100%.

② New equipment and appliances purchased by high-tech enterprises between October 1, 2022 and December 31, 2022, The one-time full amount of the current year is allowed to be deducted when calculating taxable income, and 100% super deduction is allowed before tax.

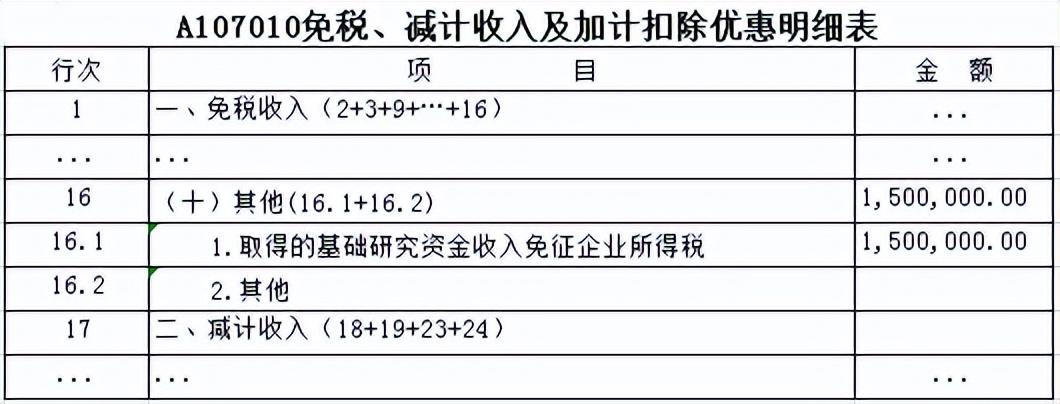

Case 1

Company A invested 1.5 million yuan in the basic research project of B non-profit research institution in May 2022. Although the Ministry of Finance The Announcement of the State Administration of Taxation on Preferential Tax Policies for Enterprises Investing in Basic Research (No. 32 of 2022) was issued in September. However, since the implementation period stipulated in the document starts from January 1, 2022, Enterprise A and Non-Profit B Research institutions can enjoy this preferential policy.

Non-profit research institution B accepts basic research funds invested by enterprise A and is exempt from corporate income tax. Fill in line 16.1, the amount is 1.5 million yuan.

In addition to being deductible before tax, the capital contribution of enterprise A can also be 100% super-deducted, which should be filled in during the annual declaration Line 30.1, the amount is 1.5 million yuan.

Case 2

Company C is a company within the validity period A high-tech enterprise will purchase a new R&D equipment worth 5.5 million yuan in October 2022. The equipment can be deducted from the corporate income tax in one go, and a 100% super deduction will be implemented before the tax. The "Details of Asset Depreciation, Amortization and Tax Adjustments" and line 30.2 of Form A107010 need to be filled in at the same time.

1. The super deduction of research and development expenses incurred in developing new technologies, new products, and new processes is specified in the "Super Deduction of Research and Development Expenses" Fill out the Discount Details Form (A107012).

2. Super deduction for related expenses incurred in creative design activities to obtain innovative, creative and breakthrough products Fill in the 28th line of the A107010 form; when filling in the report, please click the drop-down arrow on line 28 to bring up the drop-down box, and select different types to fill in according to the actual situation of the enterprise.

The filing rules and cases for super deduction of R&D expenses will be explained in detail in the next issue~

Previous recommendations

Understand the changes in corporate income tax returns for 2022 in one article (1)

One article to understand Changes in corporate income tax returns for 2022 (2)

Articles are uploaded by users and are for non-commercial browsing only. Posted by: Lomu, please indicate the source: https://www.daogebangong.com/en/articles/detail/yi-wen-du-dong-2022-nian-du-qi-ye-suo-de-shui-shen-bao-biao-de-bian-hua-san.html

支付宝扫一扫

支付宝扫一扫

评论列表(196条)

测试