The depreciation of fixed assets is a difficult point in the accounting industry, both in work and in the examination process. In particular, the calculation questions on the depreciation method of fixed assets are frequently examined and are also the focus that candidates need to master. Don’t panic when you get the job test after you learn it, let’s learn together (including cases)!

(There are free ways to get it at the end of the article!)

Depreciation method of fixed assets

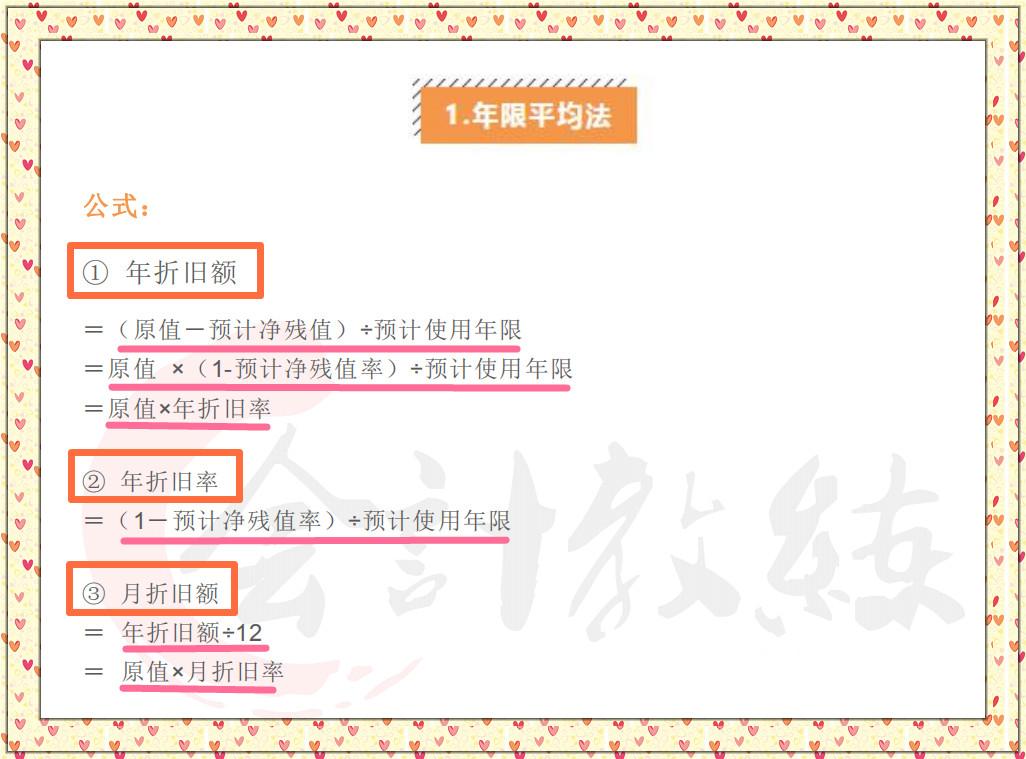

1. Yearly average method

Case 1:

A company purchased a car with an original price of 1 million yuan and an estimated useful life of 5 years.

The residual value is 100,000 yuan.

Annual depreciation = (100-10) ÷ 5 = 18 (10,000 yuan)

Annual depreciation rate = 18÷100 = 18%

Monthly depreciation=18÷12=1.5

Monthly depreciation rate = 18% ÷ 12 = 1.5%

2. Workload method

Case 2:

The original price of a fixed asset purchased by a company is 1 million yuan, and the driving range is 500,000 kilometers. The net residual value is

100,000 yuan, driving 30,000, 80,000, and 100,000 kilometers in the first, second, and third years respectively.

Depreciation amount per kilometer = (100-10) ÷ 50 = 1.8 yuan/km

Depreciation amount in the first year = 3 × 1.8 = 5.4 (10,000 yuan)

Depreciation amount in the second year = 8 × 1.8 = 14.4 (10,000 yuan)

Depreciation amount in the third year = 10 × 1.8 = 18 (10,000 yuan)

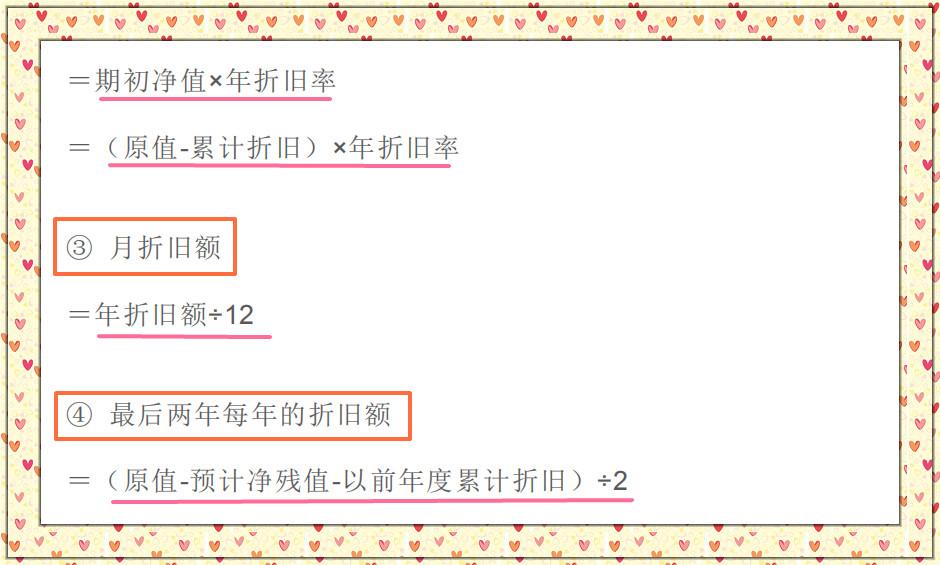

3. Double declining balance method

Case 3:

The original price of a fixed asset purchased by a company is 1 million yuan, and its estimated useful life is 5 years.

The calculated net residual value is RMB 100,000.

Annual depreciation rate = 2÷5= 40%

Depreciation amount in the first year = 100 × 40% = 40 (ten thousand yuan)

Depreciation amount in the second year = (100-40) × 40% = 24 (ten thousand yuan)

Depreciation amount in the third year = (100-40-24) × 40% = 14.4 (10,000 yuan)

Depreciation amount in the 4th and 5th years = (100-40-24-14.4-10) ÷2 = 5.8 (10,000 yuan)

Remember: the net residual value is not considered in the first n-2 years, other methods consider the net residual value, and the direct residual value is used in the last two years.

Line method.

4. Sum of years method

Case 4:

A company purchased a fixed asset with an original price of 1 million, an estimated useful life of 5 years, and an estimated net loss of

Salvage value 100,000.

Depreciation amount in the first year = (100-10) × 5 ÷ (5 + 4 + 3 + 2 + 1) = 90 × 5 ÷ 15 = 30 (ten thousand

Yuan)

Depreciation amount in the second year = 90×4÷15=24 (10,000 yuan)

Depreciation amount in the third year = 90×3÷15=18 (10,000 yuan)

Depreciation amount in the 4th year = 90×2÷15=12 (10,000 yuan)

Depreciation amount in the 5th year = 90×1÷15=6 (10,000 yuan)

It should be noted here that when calculating the annual depreciation rate, the "sum of estimated useful years" is the sum of the years.

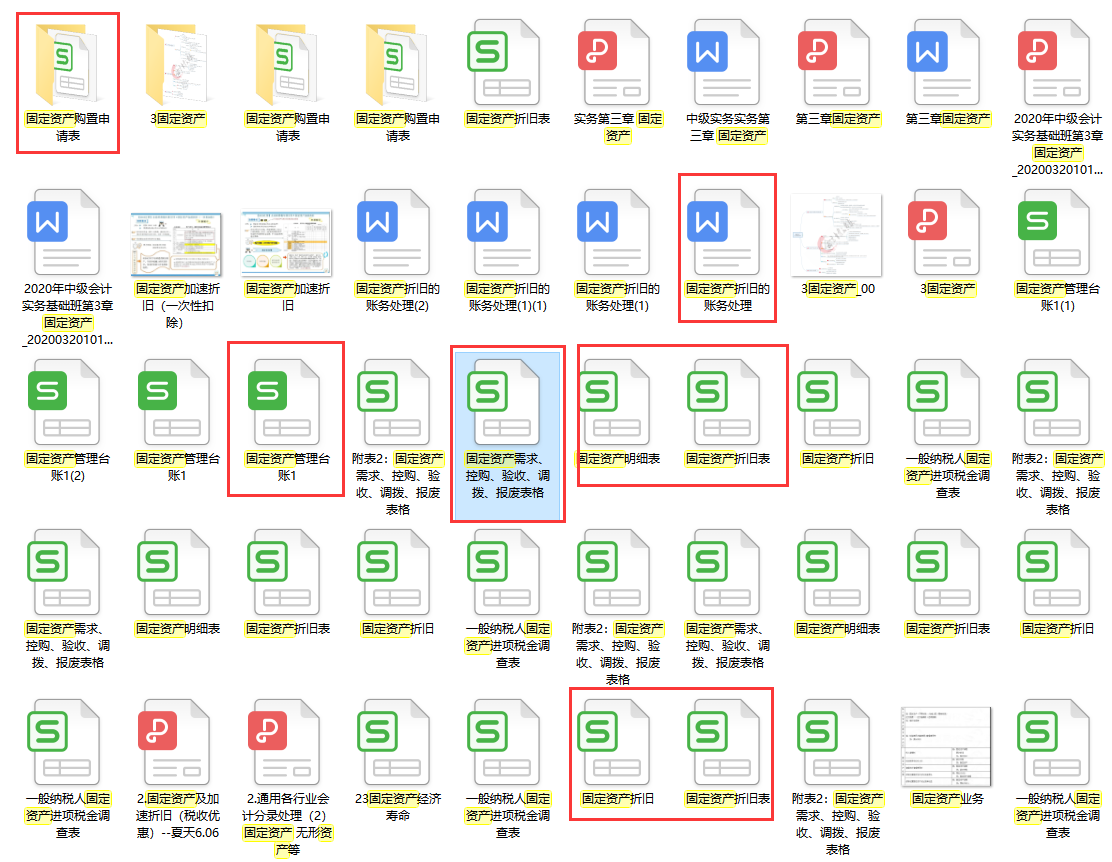

Fixed assets table

Depreciation Schedule of Fixed Assets

Details of Fixed Assets

...

Financial treatment of fixed asset depreciation

...

How to receive:

Articles are uploaded by users and are for non-commercial browsing only. Posted by: Lomu, please indicate the source: https://www.daogebangong.com/en/articles/detail/xiao-kuai-ji-xian-bei-ci-ao-ye-zheng-chu-gu-ding-zi-chan-zhe-jiu-fang-fa-an-lie-biao-ge-shou-zhong-shi.html

支付宝扫一扫

支付宝扫一扫

评论列表(196条)

测试