Since Silicon Valley Bank announced its collapse on March 10, 2023, as of March 20, U.S. time, the turmoil in the U.S. and European banking industries has not completely subsided: the stock prices of Credit Suisse and First Republic Bank "cut in half" during the day, and the price of gold once rose above the US$2,000 mark. , the market’s expectations for the economic and monetary policies of the United States and Europe have undergone drastic changes. In the short term, with most of the crisis triggers having been “doused”, we tend to believe that the “worst” is over. However, the risk of fluctuations in the banking industry has not yet completely dissipated, and the market may remain wary of assets related to small and medium-sized banks in the United States and large European banks. Looking forward, the risk of a U.S. economic recession will further increase, but the extent of the recession remains to be seen. We expect the Federal Reserve to raise interest rates by 25bp in March, but may not explicitly indicate a rate cut in the second half of the year.

01

Is the “worst” over?

In the short term, we tend to believe that the "worst period" is over, but the risk of volatility in the banking industry has not yet completely dissipated.

First of all, U.S. and European policies (and markets) responded in a timely manner, and most of the triggers of the crisis have been "doused". On March 12, the U.S. Department of the Treasury, the Federal Reserve, and the FDIC jointly established the Bank Term Rescue Plan (BTFP), and Silicon Valley Bank depositors have received "full rescue"; on March 19, UBS announced the acquisition of Credit Suisse to avoid Risk of Credit Suisse failure; on March 16, First Republic Bank (FRB) received a capital injection of US$30 billion from 11 large banks. Although First Republic Bank's stock price still fell on March 17 and 21, the worst outcome would be to declare bankruptcy or be taken over by the FDIC, which would hardly trigger systemic risks.

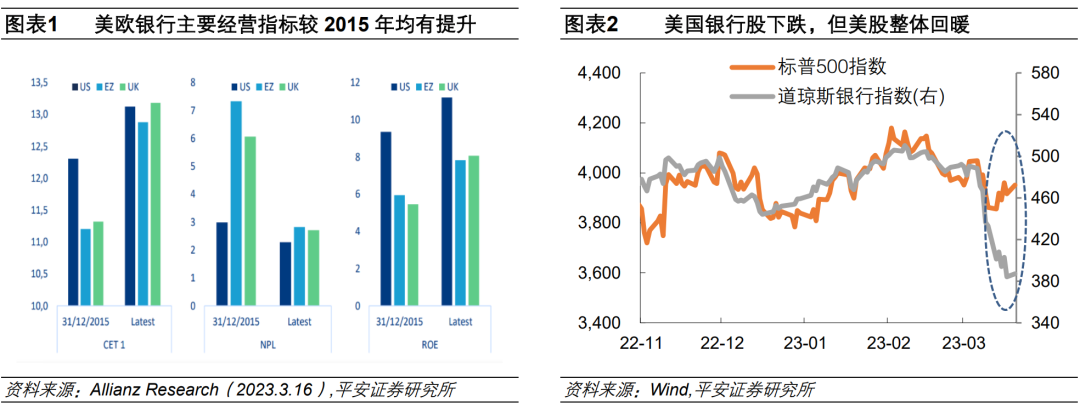

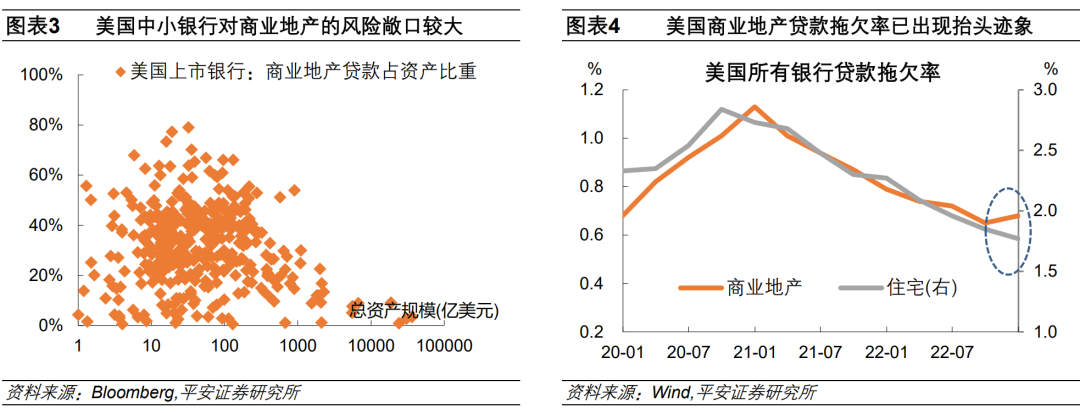

Secondly, the U.S. and European banking systems are generally sound and systemic risks should be controllable. On the one hand, the causes of the Silicon Valley Bank and Credit Suisse incidents are inseparable from their own operating risks, and may not be the "tip of the iceberg" of systemic risks. The main reason for the collapse of Silicon Valley Bank is its own business model, that is, a single source of liabilities (start-ups), more deposits and less loans (current deposits account for more than 70%), short deposits and long investments (holding treasury bonds + MBS scale accounts for more than 50% of assets). What struck Credit Suisse was that it already had a lot of credit risks and poor management. The stock price fell this time due to the failure of seeking capital injection from the Saudi National Bank, which immediately caused cash flow pressure. On the other hand, after the subprime mortgage crisis in 2008 and the European debt crisis in 2011, financial supervision in the United States and Europe was significantly strengthened, and more mature risk control mechanisms were established. In the past decade, the health of the U.S. and European banking systems has been consolidating. Important indicators such as capital adequacy ratio (CET1), bad debt ratio (NPL), and return on equity (ROE) are now more positive than at the end of 2015. In addition, the policy level has become more responsive and timely in responding to financial risks. Therefore, it may be difficult for local banking risks to evolve into systemic risks in the short term. This also explains why the Dow Jones Banking Index has fallen sharply since March 10, but the S&P 500 Index has risen modestly.

However, short-term panic in financial markets may not dissipate. On the one hand, the thunderstorms of Silicon Valley Bank, Signature Bank and First Republic Bank reflect the fragility of small and medium-sized banks in the United States. In particular, the liability side of First Republic Bank is more balanced than the previous two, and its business and valuation are even more "top students" in the industry. It is more typical and representative among small and medium-sized banks. Therefore, the crisis faced by this bank means that most small and medium-sized banks Banks may all come under pressure. In addition, in 2018, the Trump administration promoted the relaxation of financial regulations and weakened the stress test for banks with assets below 250 billion. This is also an important background for this round of thunderstorms for small and medium-sized banks. We believe that short-term concerns surrounding small and medium-sized banks may still exist, and we do not rule out new thunderstorms for small and medium-sized banks. On the other hand, the acquisition of Credit Suisse may trigger market concerns about large banks. Credit Suisse is one of the 30 banks designated as "Global Systemically Important Banks (G-SIBs)" by the world's financial supervisory agencies. It has implemented stricter capital controls than ordinary banks and should play a "ballast stone" in the global financial system. "effect. After the Credit Suisse incident, large G-SIBs banks with the same level as Credit Suisse may be short-selling and attacked by speculative funds in the short term.

02

What other possible risks are there?

In addition to the impact on US and European banks, the following economic and financial risks also deserve attention:

First, the U.S. and European banking bond markets may be affected by the Credit Suisse incident. On March 19, UBS announced that it would acquire Credit Suisse, but approximately 16 billion Swiss francs of Credit Suisse’s Additional Tier 1 (AT1) bonds will be completely written down. When banks are in crisis, AT1 bonds can help banks absorb losses by converting shares or writing down principal. Generally speaking, AT1 creditors have priority in payment order than ordinary shareholders. However, this time the Swiss regulator directly wrote down the AT1 bonds to zero, while shareholders' equity could still be retained at close to 50%. This shocked the capital market and was considered to be a "blatant violation of the creditor's payment priority system." In the future, the prices of AT1 bonds of other banks may be affected, and the capital adequacy levels of some banks may be affected.

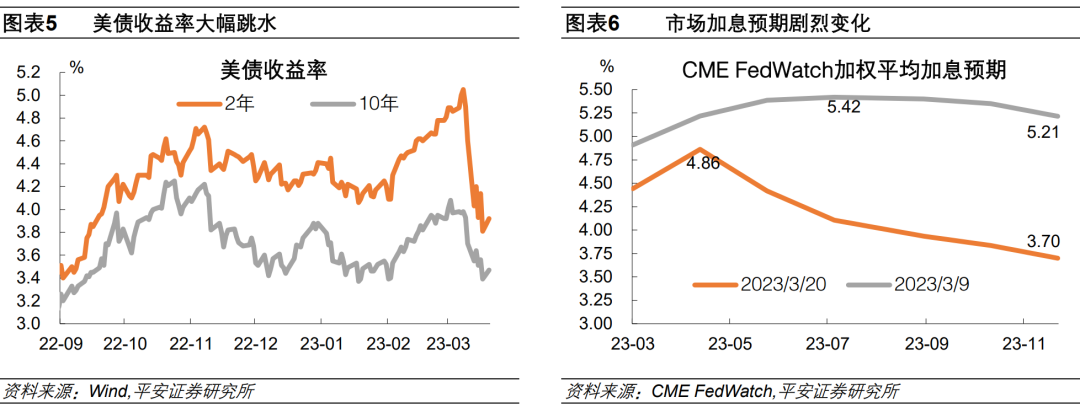

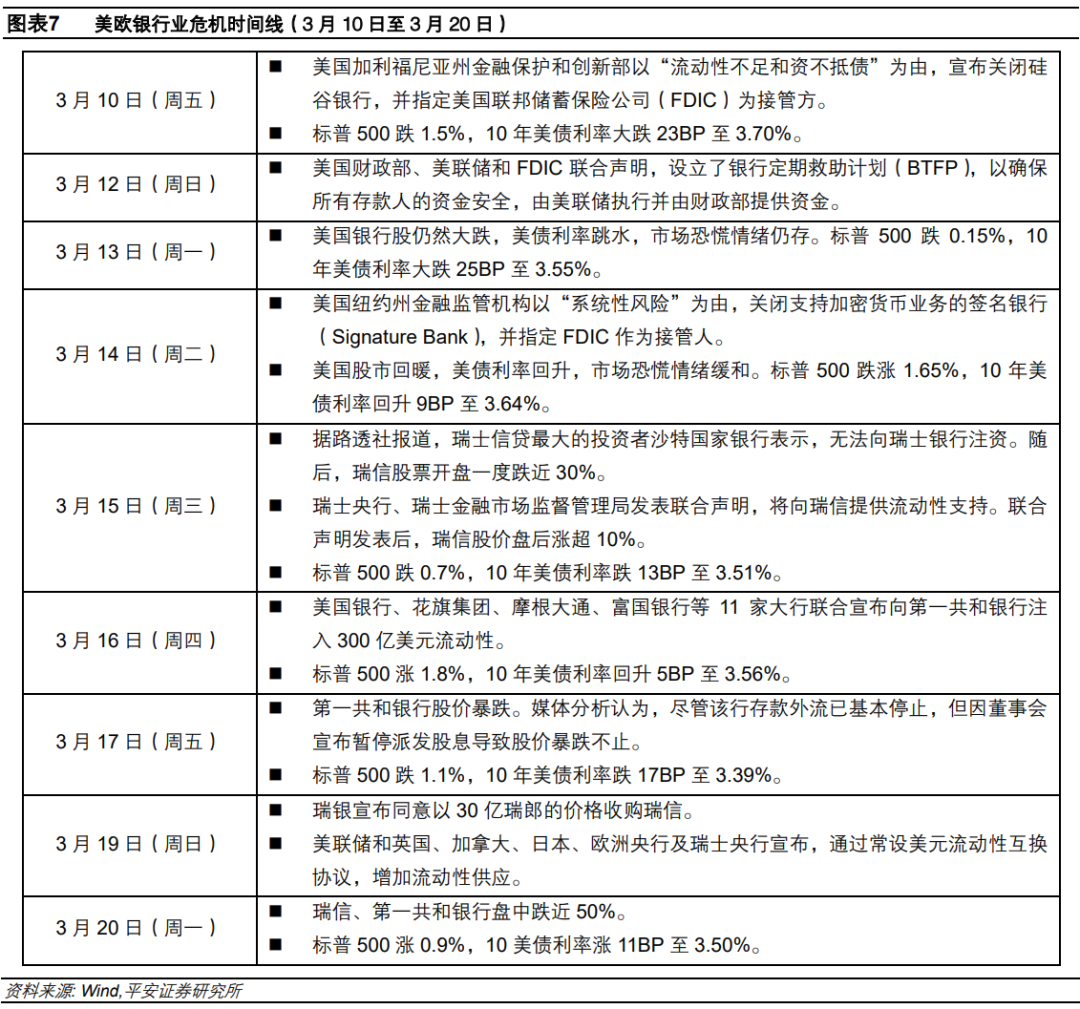

Second, U.S. commercial real estate may be further impacted by the crisis of small and medium-sized banks. In terms of risk exposure, 80% of U.S. commercial real estate loans come from smaller regional banks, which may now shrink their balance sheets in order to save themselves. In terms of signs of risk, the delinquency rate of commercial real estate mortgage-backed securities (CMBS) jumped 18 basis points month-on-month in February 2023, after Blackstone's CMBS defaulted. From a fundamental perspective, commercial real estate is more fragile than residential real estate. This is reflected in the fact that U.S. commercial real estate loan delinquency rates have shown signs of improvement as of the fourth quarter of 2022, while residential loans remain solid. In particular, working from home and hybrid working models since the epidemic have made office real estate more vulnerable to impact. From the perspective of the transmission path, commercial real estate and small and medium-sized banks may be damaged simultaneously and fall into a vicious cycle.

Third, the evolution of financial risks in the medium term still needs to be observed. Historically, financial crises often erupt only after the central banks of the United States and Europe cut interest rates for the first time (of course, it may also be the rise in financial risks that causes a shift in monetary policy). This round of Fed rate hikes is faster, and the impact on the economy and financial system will be more rapid. In particular, the persistence and depth of the inversion in U.S. bond maturity spreads have exceeded levels since 2000. All types of U.S. banks are more or less likely to have asset-liability duration mismatches. In addition, given that the performance of the banking industry and even the financial industry is highly linked to economic fundamentals, if the pressure of economic recession in the United States and Europe increases, the market's revaluation of banking industry-related assets will also amplify the pressure on the financial system. In this regard, since European economic risks are greater than those of the United States (due to greater inflationary pressure, government debt, and energy risks), European banking industry risks will also be higher than those of the United States.

03

What’s next for economics and policy?

The risk of recession in the United States has further increased. The credit crunch of small and medium-sized banks in the United States will impact the real economy. According to Goldman Sachs data, small and medium-sized banks with assets below $250 billion assume about 50% of commercial and industrial loans in the United States, including 60% of housing loans, 80% of commercial real estate loans, and 45% of consumer loans. Goldman Sachs accordingly lowered the full-year U.S. GDP growth rate by 0.3 percentage points to 1.2%. Our baseline expectation is that the United States will enter recession (as defined by the NBER) around mid-2023.

The Fed’s decision to stop raising interest rates has been brought forward to around May, but whether it will cut interest rates remains to be seen. Before the Silicon Valley Bank incident, the market once expected the Federal Reserve to continue to raise interest rates in the third quarter, with the terminal interest rate reaching above 5.5%. CME data as of March 17 shows that the market expects the last interest rate hike to be in March or May, and the cumulative interest rate cuts in the second half of the year may exceed 100 BP. Market expectations for interest rate hikes have cooled sharply, which is also reflected in the plunge in 2-year and 10-year U.S. bond yields. We believe that the Federal Reserve may continue to raise interest rates by 25BP in March, and may still raise interest rates in May or June. With reference to the European Central Bank raising interest rates by 50 BP on March 16 this year, and the Bank of England temporarily buying unlimited bonds after the pension crisis but still raising interest rates by 75 BP, it can be seen that the US and European central banks will not take it easy while taking into account financial stability. Change the previous policy path. Moreover, the Fed first "walks and watches" according to the established path, and also sends out the signal that "everything is under control", which is also very important for stabilizing market expectations and mitigating risk divergence.

It should be pointed out that the current strong expectations for a sharp interest rate cut in the second half of the year precisely include the expectation that the "financial crisis" will continue to ferment and the U.S. economy will be in a "deep recession." However, if this banking risk can be mitigated quickly, the impact on the U.S. economy may be limited. Coupled with the fact that U.S. inflation is still very sticky, the Federal Reserve may still maintain high interest rates in the second half of the year and try not to cut interest rates or cut them as little as possible.

The Fed may still use other tools to deal with financial risks. As of March 15, the Federal Reserve expanded its balance sheet by approximately US$300 billion that week. On March 19, the Federal Reserve and major central banks increased swap agreement lines to supplement U.S. dollar liquidity. Since the long-term municipal bonds held by First Republic Bank are not yet among the collateral accepted by BTFP, the Fed may consider expanding the scope of eligible collateral while the bank is still facing a crisis. In addition, when necessary, the Federal Reserve still has a wealth of conventional (mostly tools implemented after the subprime crisis) and unconventional policy tools available for use: conventional tools include the discount window and open market operations purchases. Assets such as treasury bonds, Standing Repo Facility (SRF), Term Securities Lending Facility (TSLF), etc.; unconventional tools may include suspending balance sheet reduction, increasing (or committing to) asset purchases, using fiscal Implement assistance to some TGA accounts, etc. In short, in order to resolve financial risks, the Federal Reserve will be "full firepower" in terms of liquidity support!

The market may still take "self-rescue" actions. On March 16, 11 banks in the United States jointly announced a capital injection into First Republic Bank. Wall Street does not rule out further similar actions in the future; on March 20, while the share price of First Republic Bank was still falling, large Wall Street banks The bank may further consider converting the original 30 billion deposits into equity capital, or even consider a full acquisition of it. In addition, according to a US Fox News report on March 18, the dialogue between the Biden administration and Buffett means that other investment companies such as Buffett may invest in regional US banks in some way in the future.

(Zhong Zhengsheng is the chief economist and director of the research institute of Ping An Securities)

Articles are uploaded by users and are for non-commercial browsing only. Posted by: Lomu, please indicate the source: https://www.daogebangong.com/en/articles/detail/mei-ou-yin-hang-ye-wei-ji-he-shi-le.html

支付宝扫一扫

支付宝扫一扫

评论列表(196条)

测试