- Picture and text skills

- Case

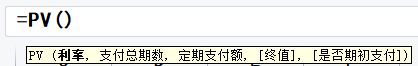

Returns the present value of the investment. Present value is the cumulative sum of the current values of a series of future payments. For example, a borrower's borrowed money is the present value of a lender's loan.

Syntax

• rate is the interest rate for each period.

For example, if you borrow a loan to buy a car at an annual interest rate of 12% and repay the loan monthly, the monthly interest rate is 12%/12 (or 1%). Available at

Enter 12%/12, 1%, or 0.01 as the rate value in the formula.

• nper is the total investment (or loan) period, that is, the total number of payment periods for the investment (or loan).

For example, for a 5-year car loan with monthly repayments, there are 5*12 (i.e. 60) repayment periods. You can enter 60 as the value of nper in the formula.

• pmt is the amount payable in each period, and its value remains unchanged throughout the annuity period. Usually pmt includes principal and interest, but does not include other fees and

Tax. For example, the monthly payment on a $10,000 four-year car loan at 12% APR would be $263.33. You can enter -263.33 into the formula

is the value of pmt. If pmt is omitted, the fv parameter must be included.

• fv is the future value, or the expected cash balance after the last payment. If fv is omitted, it is assumed to be zero (the future value of a loan is zero).

For example, if $60,000 is required to be paid in 12 years, then $60,000 is the future value. The monthly deposit amount can be determined based on a conservative estimate of the interest rate.

If fv is omitted, the pmt parameter must be included.

• type A number 0 or 1 that specifies whether payment is due at the beginning or end of each period.

Articles are uploaded by users and are for non-commercial browsing only. Posted by: Lomu, please indicate the source: https://www.daogebangong.com/en/articles/detail/jing-tong-PV-han-shu-jing-suan-tou-zi-xian-zhi-de-cai-wu-ji-qiao.html

支付宝扫一扫

支付宝扫一扫

评论列表(196条)

测试