The actual controller of Founder Securities Co., Ltd. (hereinafter referred to as "Founder Securities", 601901) will be officially changed to Ping An Insurance (Group) Co., Ltd. of China (hereinafter referred to as "Ping An of China").

On the evening of December 20, Founder Securities issued the "Announcement on Approval to Change Major Shareholders and Actual Controllers" stating that according to the effective reorganization plan of Peking University Founder Group Co., Ltd. (hereinafter referred to as "Founder Group"), Founder Group and its concerted actions All 28.71% of the company's shares held by Founder Industrial Holdings Co., Ltd. will be transferred to the newly established New Founder Holdings Development Co., Ltd. (hereinafter referred to as "New Founder Group"), and the company's controlling shareholder plans to be changed to New Founder Group.

"Ping An of China intends to hold the equity of New Founder Group and indirectly control the company through the SPV shareholding platform established by its controlling subsidiary Ping An Life Insurance Co., Ltd. of China (hereinafter referred to as 'Ping An Life'). On December 20, the company received The China Securities Regulatory Commission approved that after New Founder (Beijing) Enterprise Management Development Co., Ltd. became the controlling shareholder of New Founder Group, it approved Ping An of China to become the actual control of Founder Securities, Founder Securities Underwriting and Sponsoring Co., Ltd., Founder Fubon Fund Management Co., Ltd., etc. people.” Founder Securities’ announcement further stated.

It is worth mentioning that as the actual controller of Founder Securities changes to Ping An of China, the issue of horizontal competition between it and Ping An Securities Co., Ltd. (hereinafter referred to as "Ping An Securities") will also come to the forefront. Previously, after Ping An Group participated in the reorganization of Founder Group, rumors of a merger between the two securities firms continued to spread.

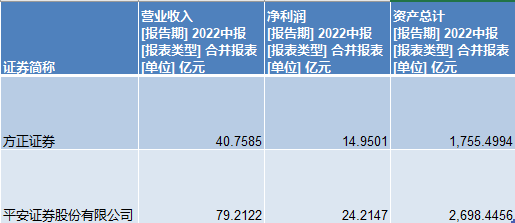

Calculated based on the operating data of the 2022 interim report, if Founder Securities and Ping An Securities merge, multiple performance indicators such as revenue, net profit, and total assets will rank among the top ten in the industry.

Ping An of China will become the actual controller

The announcement pointed out that on December 20, Founder Securities received the China Securities Regulatory Commission's "Approval of the Change of Major Shareholders and Actual Controllers of Founder Securities Co., Ltd. and the Change of Actual Controllers of Founder Securities Underwriting and Sponsor Co., Ltd. and Founder Fubon Fund Management Co., Ltd." 》 (hereinafter referred to as the "Approval"), has no objection to New Founder Group's legal transfer of 2.363 billion shares of Founder Securities (accounting for 28.71% of the total shares), and approves New Founder Group to become the major shareholder of Founder Securities.

"After New Founder (Beijing) Enterprise Management Development Co., Ltd. became the controlling shareholder of New Founder Group in accordance with the law, Ping An of China was approved to become Founder Securities, Founder Securities Underwriting and Sponsoring Co., Ltd., and Founder Fubon Fund Management Co., Ltd. (hereinafter referred to as 'Founder Fubon') The actual controller of Bang Fund')." The "Approval" further pointed out.

Founder Securities stated that this approval to change the major shareholders and actual controllers will result in the company’s controlling shareholder changing to the new Founder Group, and will also lead to changes in the actual controllers.

Public information shows that Founder Group was founded by Peking University in 1986. It started in the IT industry. After more than 30 years of development, it has gradually formed business sectors such as IT, medical medicine, industrial real estate, finance and commodity trading. But at the end of 2019, Founder Group defaulted on a 2 billion yuan ultra-short-term financing bond, detonating the debt crisis.

In February 2020, Founder Group was ordered to reorganize by the Beijing No. 1 Intermediate People's Court (hereinafter referred to as "Beijing No. 1 Intermediate Court"). In July 2021, the administrator of Peking University Founder Group Co., Ltd. received a "Civil Ruling" from Beijing No. 1 Intermediate People's Court, which approved the reorganization plan of five companies including Founder Group.

Founder Securities stated in the "Announcement on the Progress of the Reorganization of Controlling Shareholders" released at the same time on the evening of December 20 that the company received a letter from Founder Group that the equity of New Founder Group held by Founder Group and other five companies had been transferred in December. On the 15th, the change was registered to New Founder (Beijing) Enterprise Management Development Co., Ltd., the designated entity of the investor Ping An Life Insurance, and Zhuhai Huanxin Founder Investment Partnership (Limited Partnership), the designated entity of the investor Zhuhai Huafa Group Co., Ltd. (representing Zhuhai State-owned Assets).

"The equity structure of New Founder Group is: New Founder (Beijing) Enterprise Management Development Co., Ltd. holds 66.507% of the shares, Zhuhai Huanxin Founder Investment Partnership (Limited Partnership) holds 28.503% of the shares, and the creditor shareholding platform Zhuhai Founder No. 1 Enterprise The management partnership (limited partnership) holds 1.63% of the shares, and the creditor shareholding platform Zhuhai Founder No. 2 Enterprise Management Partnership (limited partnership) holds 3.36%," the announcement showed.

On the evening of December 20, relevant listed companies including Ping An of China (601318), Founder Securities, China Hi-Tech (600730), Peking University Pharmaceuticals (000788), *ST Fangke (formerly Founder Technology, 600601), etc. all issued "About Peking University Founder" Announcement on the progress of the reorganization of the Group Co., Ltd."

There are constant speculations about the merger of the two securities firms. If multiple performance indicators are merged, they will rank among the top ten in the industry

It is worth noting that as Ping An of China becomes the actual controller of Founder Securities, the issue of horizontal competition between Founder Securities and Ping An Securities will also come to the forefront.

Official website information shows that Ping An Securities is an important member of Ping An of China. It was formerly the Ping An Insurance Securities Business Department founded in August 1991. It currently owns Ping An Caizhi Investment Management Co., Ltd., Ping An Futures Co., Ltd., and Ping An of China Securities (Hong Kong) Co., Ltd. , Ping An Panhai Capital Co., Ltd. and four other subsidiaries.

On January 29, 2021, Ping An of China issued an announcement about participating in the reorganization of Founder Group. Since then, rumors about the merger of Ping An Securities and Founder Securities have spread frequently, and market-related speculations have continued.

It is worth mentioning that based on the statistics of the 2022 interim report, if Ping An Securities and Founder Securities truly merge, multiple indicators such as revenue and net profit will rank among the top ten in the industry.

Wind data shows that as of mid-2022, Ping An Securities has achieved revenue of 7.921 billion yuan, and Founder Securities has achieved revenue of 4.076 billion yuan. After adding up, the total revenue of over 10 billion yuan is 11.997 billion yuan, which will rank 9th in the industry.

In terms of net profit, as of mid-2022, Ping An Securities’ net profit was 2.421 billion yuan, and Founder Securities’ net profit was 1.495 billion yuan. The total net profit level of 3.916 billion yuan will also rank ninth in the industry.

In terms of total assets, as of mid-2022, Ping An Securities’ total assets were 269.845 billion yuan, and Founder Securities’ total assets were 175.550 billion yuan. After adding up, the total assets level is 445.395 billion yuan, which will rank 10th in the industry.

There have been frequent rumors about brokerage mergers in the past two years

It is worth noting that as regulations encourage the creation of aircraft carrier-level securities companies through market-oriented mergers and acquisitions, rumors of mergers of domestic securities companies have appeared frequently in the past two years.

For example, CITIC Securities (600030) and CITIC Construction Investment (601066), two leading domestic securities firms, have repeatedly been rumored to merge. Among them, in 2020, merger news appeared five times in four months.

In addition, different securities firms in the same region have also reported merger news and caused changes in stock prices, such as Guoyuan Securities (000728) and Huaan Securities (600909) in Anhui Province, and Haitong Securities ( 600837), Guotai Junan (601211), Orient Securities (600958), etc.

It is worth mentioning that on September 20, 2020, Guolian Securities (601456) and China International Finance Securities (600109) both issued announcements to formally confirm the merger. However, the merger of the two brokerages ultimately fell through.

“There are frequent news about mergers of securities firms in the market, mainly because the current scale of domestic securities firms is generally small. In the context of regulators proposing to build an aircraft carrier-level leading securities company, and in addition, the current development of the securities industry is attracting more and more attention from all parties. , so there are more and more speculations about the merger of securities firms." A person in charge of the investment banking business of a securities firm told The Paper.

Articles are uploaded by users and are for non-commercial browsing only. Posted by: Lomu, please indicate the source: https://www.daogebangong.com/en/articles/detail/fang-zheng-zheng-quan-yi-zhu-zhong-guo-ping-an-jiang-cheng-shi-kong-ren-yu-ping-an-zheng-quan-tong-ye-jing-zheng-wen-ti-dai-jie.html

支付宝扫一扫

支付宝扫一扫

评论列表(196条)

测试