- Picture and text skills

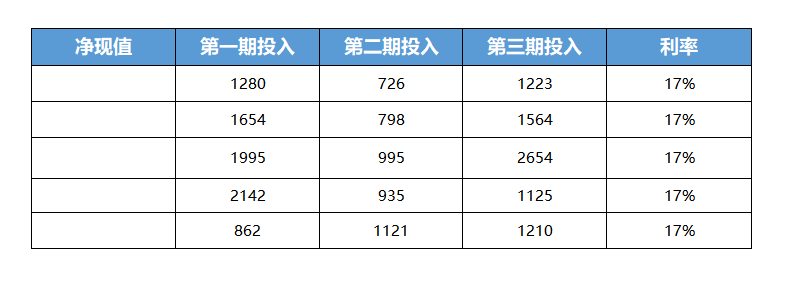

- Case

Returns the net present value of an investment using a discount rate and a range of future expenses (negative values) and income (positive values).

Syntax

NPV(rate,value1,value2,...)

rate is the discount rate for a certain period, which is a fixed value.

rate is the discount rate for a certain period, which is a fixed value.

Value1, value2, ... are 1 to 29 parameters, representing expenditure and income.

• Value1, value2, ... must be equally spaced in time and all occur at the end of the period.

• NPV uses the sequence of Value1, Value2, ... to explain the sequence of cash flows. So be sure to make sure that the amounts for expenses and income are entered in the correct order.

• If the parameter is a numeric value, a blank cell, a logical value, or a text expression of a number, it will be counted;

If the parameter is an error value or text that cannot be converted to a numeric value, it is ignored.

• If the argument is an array or reference, only the numbers in it are evaluated.

Blank cells, logical values, text, and error values in arrays or references will be ignored.

Description

• Function NPV assumes that investment begins in the period before the date of the cash flow of value1 and ends in the current period of the last cash flow. Function NPV basis

Future cash flows are used to calculate. If the first cash flow occurs at the beginning of the first period, then the first cash flow must be added to the end of the function NPV

in the result and should not be included in the values parameter.

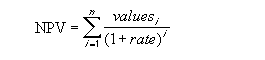

• If n is the number of cash flows in the numerical parameter table, the NPV formula is as follows:

• Function NPV is similar to function PV (present value). The main difference between PV and NPV is that the function PV allows cash flows to begin at the beginning or end of the period.

Unlike the variable cash flow values of NPV, each cash flow of PV must be fixed throughout the investment.

• Function NPV and function IRR (internal return rate), the function IRR is the ratio that makes NPV equal to zero: NPV(IRR(...), ...) = 0.

Articles are uploaded by users and are for non-commercial browsing only. Posted by: Lomu, please indicate the source: https://www.daogebangong.com/en/articles/detail/biao-ge-cai-wu-han-shu-qiao-yong-NPV-han-shu-yi-miao-ji-suan-shou-zhi-jing-e.html

支付宝扫一扫

支付宝扫一扫

评论列表(196条)

测试