- Picture and text skills

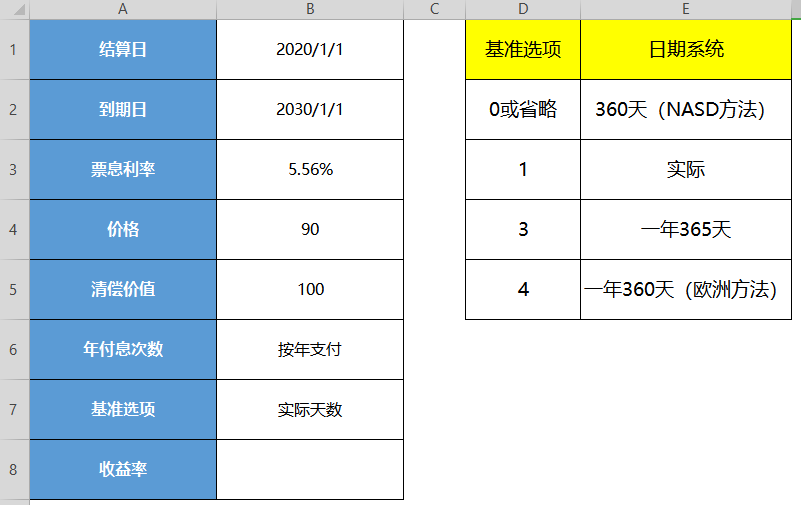

- Case

Returns the yield on a bond that pays periodic interest. The function YIELD is used to calculate bond yields.

Grammar

YIELD(settlement, maturity, rate, pr, redemption, frequency, [basis])

Important: Dates should be entered using the DATE function or as the result of another formula or function.

For example, use the function DATE(2008,5,23) to enter May 23, 2008. The problem occurs if the date is entered as text.

YIELD function syntax has the following parameters:

Settlement Required. The settlement date of a security. The settlement date of the securities is the date after the issuance date when the securities are sold to the purchaser.

Maturity Required. The maturity date of a security. The expiry date is the date when a security expires.

Rate Required. The annual coupon rate of a security.

Pr Required. The price of a marketable security (based on a par value of $100).

Redemption Required. The liquidation value of a security with a face value of $100.

Frequency Required. Number of annual interest payments.

If you pay annually, frequency = 1; if you pay semiannually, frequency = 2; if you pay quarterly, frequency = 4.

Basis Optional. The type of day count basis to use.

Description

■WPS tables store dates as serial numbers that can be used for calculations. By default, the serial number for January 1, 1900 is 1, and for January 1, 2008

The serial number is 39448 because it is 39448 days from January 1, 1900.

■The settlement date is the date when the buyer purchases the coupon (such as a bond). The maturity date is the date when the coupon expires. For example, issued on January 1, 2008

's 30-year bond was bought by the buyer six months later. Then the issuance date is January 1, 2008, the settlement date is July 1, 2008, and the maturity date is in issuance

30 years after January 1, 2008, that is, January 1, 2038.

■Settlement, maturity, frequency and basis will be truncated.

■If settlement or maturity is not a valid date, function YIELD returns the error value #VALUE!.

■If rate < 0, function YIELD returns the error value #NUM!.

■If pr ≤ 0 or redemption ≤ 0, function YIELD returns the error value #NUM!.

■If frequency is not a number 1, 2, or 4, function YIELD returns the error value #NUM!.

■If basis < 0 or basis > 4, function YIELD returns the error value #NUM!.

■If settlement ≥ maturity, function YIELD returns the error value #NUM!.

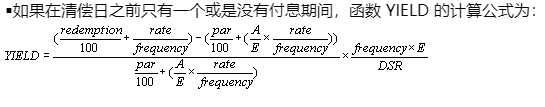

■Among them:

A = The number of days between the first day of the interest payment period and the settlement date (accrual days).

DSR = number of days between settlement date and settlement date.

E = The number of days included in the interest payment period.

■If there are multiple interest payment periods before redemption, function YIELD is calculated through 100 iterations.

■Based on the formula given in the function PRICE, and uses Newton's iteration method to continuously correct the calculation results.

In this way, the yield will continue to change until the estimated price calculated based on the given yield is close to the actual price.

Articles are uploaded by users and are for non-commercial browsing only. Posted by: Lomu, please indicate the source: https://www.daogebangong.com/en/articles/detail/biao-ge-cai-wu-han-shu-YIELD-han-shu-ji-suan-ding-qi-zhi-fu-li-xi-zhai-quan-shou-yi-lyu.html

支付宝扫一扫

支付宝扫一扫

评论列表(196条)

测试