- Picture and text skills

- Case

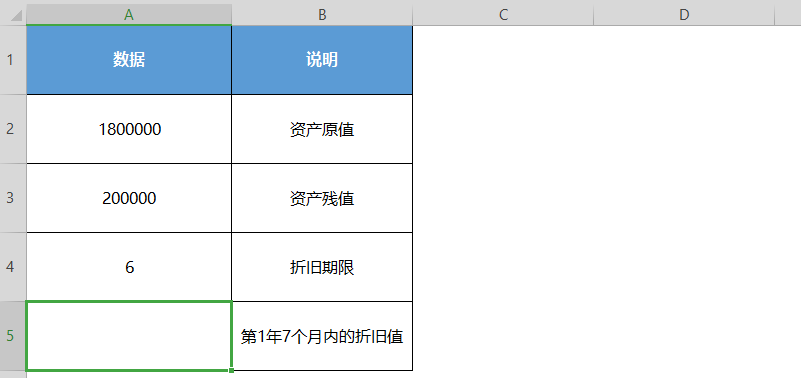

Calculate the depreciation value of an asset over a given period using the declining fixed balance method.

Syntax

DB(cost,salvage,life,period,month)

cost is the original value of the asset.

salvage is the value of the asset at the end of the depreciation period ( Also known as asset salvage value).

life is the depreciation period (sometimes also called the useful life of the asset).

period is the period for which depreciation value needs to be calculated. Period must use the same units as life.

month is the number of months in the first year, If omitted, 12 is assumed.

Description

• The fixed declining balance method is used to calculate the depreciation value of assets under a fixed interest rate. The function DB uses the following calculation formula to calculate the depreciation value for a period:

(cost - total depreciation value in the previous period) * rate

In the formula:

rate = 1 - ((salvage / cost) ^ (1 / life)) , keep 3 decimal places

• The first Period and last period depreciation are special cases. For the first period, the calculation formula of function DB is:

cost * rate * month / 12

• For the last period, the calculation formula of function DB is:

((cost - total depreciation value in the previous period) * rate * (12 - month)) / 12

Articles are uploaded by users and are for non-commercial browsing only. Posted by: Lomu, please indicate the source: https://www.daogebangong.com/en/articles/detail/biao-ge-cai-wu-han-shu-DB-han-shu-ji-suan-gei-ding-qi-jian-nei-zhe-jiu-zhi.html

支付宝扫一扫

支付宝扫一扫

评论列表(196条)

测试