- Image and text skills

Personal income tax has always been a topic of great concern to everyone, because personal income tax is related to the actual salary everyone receives.

The new personal income tax will be implemented on January 1, 2019. The following will explain in detail how to use WPS to calculate the new personal income tax in 2019.

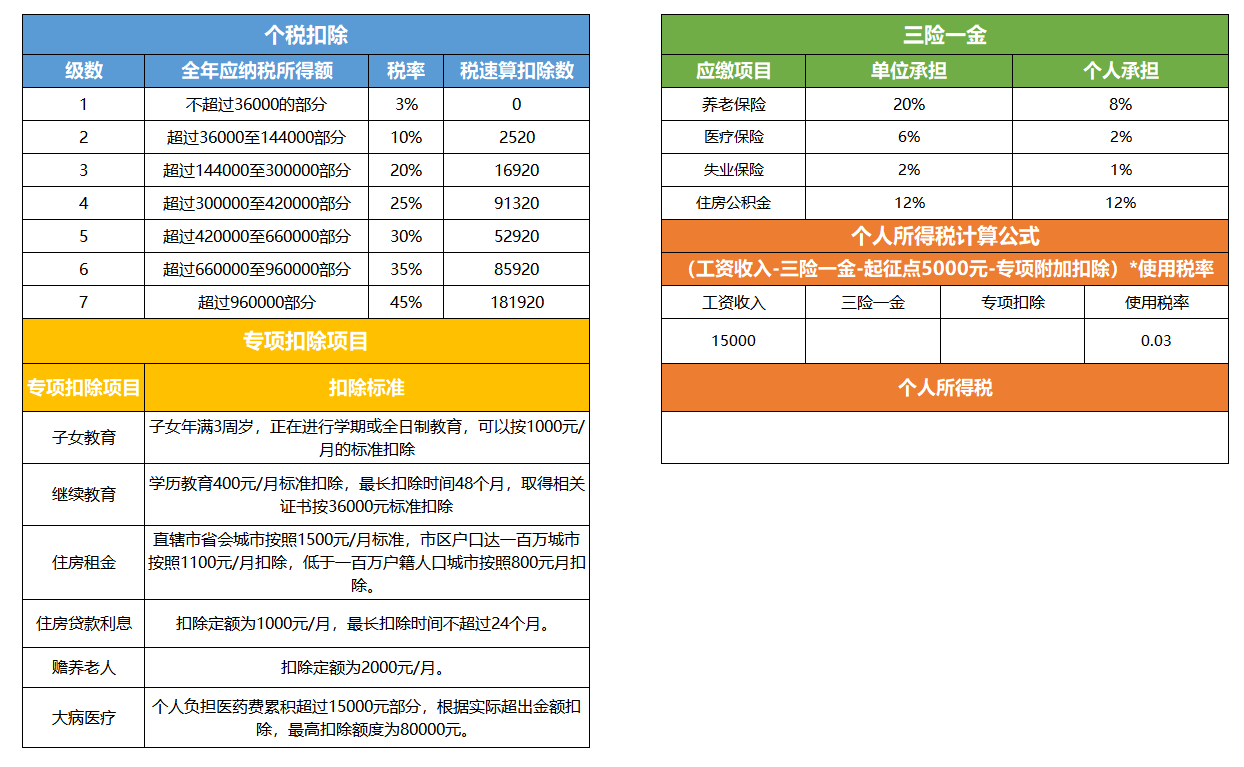

The calculation formula for the new personal income tax is:

(Salary income - three insurances and one fund - starting point 5,000 yuan - special additional deductions) *Use tax rate

Take this tax form as an example.

Assume that Mr. Li's monthly income is 15,000 yuan and he rents a house in Beijing.

Please calculate Mr. Li’s personal income tax for the current month.

■Place the cursor at H11 and enter the formula:

=G11*J4+G11*J5+G11*J6+G11*J7

Press Enter to confirm, and you can get the amount of the three insurances and one fund.

According to the special additional deduction rules for the new personal income tax in 2019,

Because Mr. Li rents a house in Beijing, he can deduct the housing rent at the standard of 1,500 yuan per month.

So enter 1500 at I11.

■Place the cursor at G13 and click Insert Function - Common Formulas - Calculate Personal Income Tax (after 2019/1/1).

Enter G11-5000-H11-I11 in "Taxable Amount for the Current Period".

Because we want to calculate the personal income tax for the current month, enter 0 in "Accumulated tax payable in previous periods" and "Accumulated tax deductions in previous periods".

Click OK to get Mr. Li's personal income tax for the current month.

Such a practical tip, please share it with your friends!

Articles are uploaded by users and are for non-commercial browsing only. Posted by: Lomu, please indicate the source: https://www.daogebangong.com/en/articles/detail/WPS-ji-suan-2019-nian-xin-ge-ren-suo-de-shui-yi.html

支付宝扫一扫

支付宝扫一扫

评论列表(196条)

测试